The fastest growing UCaas that no ones heard of?

Shares Outstanding 22M

Stock Price $3

Mkt Cap $67m

Cash $5m

EV

Insider ownership >60%

BACKROUND

1. Company description.

1. Crexendo ‘CDXO’

Crexendo is a relatively unknown UCaaS (Unified Communications as a Service) provider based in the USA.

Crexendo offers a complete telecommunication offering systems via the cloud. The existing mode of telephony is conducted via cable. UCaaS is conducted via internet/cloud. There are many advantages to using internet-based communications. In addition to talking via phone you can now communicate via video conference, instant messaging & more. Users could even control their phone calls from their mobile device. Another advantage is no more requiring large hardware units on site.

The industry is very competitive as there is no barriers to entry. Competitors that come to mind are 8x8, Vonage, Ringcentral, and many more. Some may focus predominantly to the call centres industry.

The industry business model is pay per seat. Depending on the UCaaS package, each seat (phone line) would typical cost anywhere from $20 to $30+ per month.

The main sales route for CXDO is to partner with resellers. CXDO receive a wholesale price from the reseller for every seat that they sell. The resellers sell to the end consumer (in this case a business). The resellers sell at retail prices. CXDO also has a small sales team that are targeting larger clientele that the resellers do not target.

This model helps CXDO manage their cost structure & increase revenue effectively, though margins can be compressed as they only get to keep a smaller part of the pie. Inversely they save on sales & marketing costs, by partnering with resellers. In truth in this industry the majority of participants sell via resellers as well as direct.

So how does CDXO differentiate itself from its competitors. Customer service!

In March 2021 Crexendo purchased NetSapiens. NetSapiens use their own platform, and not a 3rd party such as Broadsoft (owned by Cisco) meaning they are in full control from A>Z of the infrastructure, software & features.

In addition, to owning their own platform Crexendo added 1.7 Million customers of NetSapiens. NetSapiens offers their platform to other UCaaS providers as an alternative to the Broadsoft/Metaswich offering.

Resellers are able to purchase the infrastructure from NetSapiens and they in turn can manage their business clients. Alternatively, resellers that want to have control of the platform but not necessarily wanting to layout a significant upfront cost for the infrastructure can use the infrastructure on a saas type offering from Netsapiens.

Essentially, it is another avenue of how resellers & UCaaS providers wish to partner with Netsapiens (Now owned by Crexendo)

1. Sell direct

2. Agent model

3. NetSapiens platform sold to UCaaS providers

The UCAAS market is still in growth stage. It is estimated that only 40% of companies use cloud-based telephony. 8x8, RingCrentral have been growing at appx 30% or higher annually since inception. There is still a long runway for growth.

CXDO’s growth has been lower than its competitors (appx 15% annually & more recently growth of 20%)

Even though growth is low compared to competitors’, CXDO has a road map to achieve sales of $100M within 2-3 years. Current revenue FY21 $28M, which I will elaborate on later.

Financials:

Balance sheet is clean. No long-term debt, and currently hold over $5.7M of cash (31.03.22)

Balance sheet: (Dec 21)

In 2013 CXDO decided to change focus from its Web services - SEO & website hosting etc, to VOIP. In addition, sales were now channelled from B2C to B2B. The sales channel was to focus on Resellers and no longer in the form of webinar.

Since 2015 sales increased Quarter-over-Quarter aside from one.

Steven Mihaylo stated on the Q1 22 earnings call that he expects revenue to be over $40M for FY.

“Well, let me tell you something. It's a 2-edge sword to give out guidance, if you will. If you make it or beat it, it's positive. If you miss it and there's a lot of reasons why you might miss it, it's negative. But one thing that I have said is we expect, or I expect that our sales will increase 40% to 50%. If you just look at that, based on where we are, we should hit north of $40 million this year. And I expect -- I'll be disappointed if it's just $40 million. But right now, that's higher than any analyst hasn't said. I think that there might be a couple that are right at $40 million.”

In 2021 revenue jumped 70%+ due to the acquisition of Netsapians which also added 1.7Million users to Crexendos platform.

Gross margins decreased to ~60% due to the acquisition. Management addressed this query in the Q1 22 earnings call. They intend to get margins to over 70% in the mid-longer term. The integration and changing business model from one-time fees to subscription based will only show in the margins next year.

I mentioned that they intend to grow revenue to $100M within the next 2-3 years. The playbook is through acquisitions.

The Netsapiens acquisition was well timed, the acquisition was financed with $10M in cash, $16M ($5.47) of newly issued stock and $22M of stock options financed by their stock which at the time was richly valued.

Company Outlook:

There will continue to be organic growth, but the intention is to grow via M&A. The optionality to grow via M&A is within the pool of the 205 licensees currently reselling Crexendos services.

Steven Mihaylo the founder and current CEO is a veteran in building a telephony business he sold Intertel to Mitel for appx $720M. Intetel revenue run rate at the time was ~$500m.

After selling Steven decided to repeat this playbook only this time within the UCaaS space.

Some resellers have already expressed interest to sell to CDXO. CXDO would like to complete their first acquisition before YE2022

I should note that the company has been profitable from a GAAP perspective over the previous two years. Management have shown signs that know how to run a business conservatively.

Any M&A activity will incur debt and share dilution. It has been made clear that any acquisitions will be profit accretive.

Steven owns 47% outstanding shares and has recently purchased over 100,000 shares on the open market.

Historic 1st Qtr 2013 Rev increased to $385K from $75K the prior year quarter. Since then revenue has been increasing quarterly y-o-y. Revenue for 1st Qtr 2022 was $8.2M. impressive figures albeit starting from a low revenue base.

Steven Mihaylo the founder and current CEO is a veteran in building a telephony business he built Intertel into a $500M revenue business prior to selling it to Mitel for appx $720M.

http://www.stevemihaylo.com/about-steve According to this link from 1969 when he founded Inter-Tel Steven raised $100M in four public stock offerings and between 1998-2007 returned appx $100M to shareholders in dividends, & also returned ~$200M in the form of stock repurchases between 1986-2005 and then finally sold Inter-Tel for $750M in 2007.

It would be apparent that Mr Mihaylo is a proficient capital allocator. He now plans on repeating his achievement once again.

Competition:

The market is large and continues to grow at a fast pace. The world is still in transition stage from legacy telecommunications to UCaaS.

(Revenue figures LTM)

· RingCentral - $1.6Bn

· 8x8 - $602M

· Vonage - $1.3Bn

· Crexendo - $30M

The runway is long & clearly demand is there.

Some competitors have debt on the balance sheet and have diluted share count over the past years. Stock based compensation of some competitors have been large.

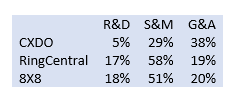

I estimate operating margins can conservatively achieve 10% based on competitors’ figures, and CXDO is focused on keeping costs under control.

In 2014 Steven showed his commitment to the firm.

“I continue to not only say I believe in the Company but support that belief by my actions, in the 10Q we have filed today, you will see I have continued to agree to provide backstop financing to the Company if that becomes necessary.”

Since Jan 2022 Steven has purchased over 700,000 shares in the open market and current owns over 47% of the company.

Below is a little insight as to how management think.

In short, I believe the company is on a growth trajectory mainly through M&A and I believe the acquisition s will be earnings accretive. Management knows how to keep costs in check. As they scale costs will get in line or even better than competition.

2021 numbers:

Pros:

1. Underfollowed

2. High insider ownership – seasoned CEO

3. Debt free

4. Clear focus to reach $100M in sales

5. Customer reviews positive compared to competition

6. Focused on margins and costs

Risk:

1. Steven Mihaylo’s successor?

2. Fail with M&A and any synergies

3. Competitors lower fees to bleed smaller players (not likely as ARPU of comps have increased)

4. Take on unsustainable amount of debt

5. Share dilution